Keyword: Personal Tax Planning

-

Autumn Budget 2025: Impact On SMEs

26 November 2025The second Autumn Budget delivered by a Labour government in over a decade has landed, and Chancellor Rachel Reeves says it involves “fair and necessary” […]

-

Empowering Women in Financial Literacy

12 November 2025Financial literacy is power – let’s strengthen that power together. Many women feel uncertain about financial decisions, not because they lack capability, but because the […]

-

The Countdown to MTD ITSA: Are You Ready for April 2026?

28 October 2025The next stage of Making Tax Digital (MTD) is finally coming into effect… and this time, it’s official. From April 2026, the way many individuals report their income […]

-

Financial Planning for High-Income Earners – Free Webinar this Sep...

27 August 2025Do You Ever Feel Like You’re Saving Less Than You Should While Being on a High Salary? If the answer is YES, you’re not alone. The […]

-

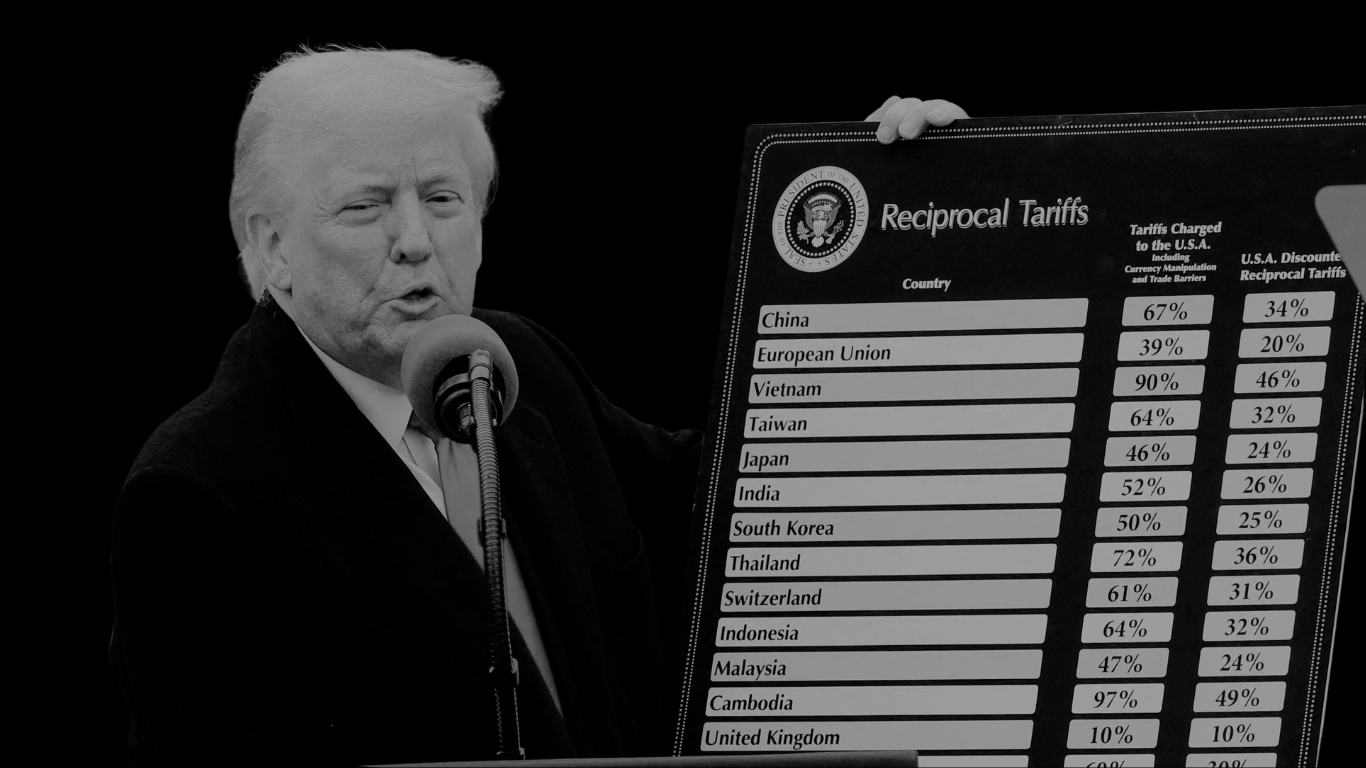

OBR Warns: Higher Taxes Could Harm UK Growth and Government Strategy...

21 August 2025The Office for Budget Responsibility (OBR) has issued a stark warning to the Treasury, suggesting that further tax increases could hinder the UK’s economic growth […]

-

HMRC Launches Daily £10 Fine for Late Tax Returns

8 August 2025HMRC has just launched a stricter penalty system for people who still have not submitted their Self-Assessment tax return and the cost is climbing every […]

-

Why Rachel Reeves’ Spending Review Could Change Everything

30 July 2025Earlier this month, Chancellor Rachel Reeves delivered her first Spending Review since stepping into the role. This review sets out how the government plans to […]

-

Will Rachel Reeves Backtrack on Inheritance Tax for Non-Doms? What B...

21 July 2025The inheritance tax shake-up that is shaking up the City Chancellor Rachel Reeves is facing growing pressure to reverse recent tax reforms targeting non-domiciled individuals, […]

-

Shop Prices Are Rising Again – What You Should Know

16 July 2025For the first time in nearly a year, shop prices in the UK have returned to inflation. According to the British Retail Consortium (BRC) and […]