Keyword: Personal Tax Planning

-

ATED Update – Everything You Need to Know In 2025

18 March 2025With the ATED filing deadline fast approaching on 30th April, here are some top tips from one of our tax specialists, Raj Bassi.

-

Financial Well-Being For Neurodivergent Business Owners

7 March 2025Nordens and Mindset have partnered to bridge the support gap, combining financial expertise with specialist neurodiversity coaching to empower neurodivergent business owners.

-

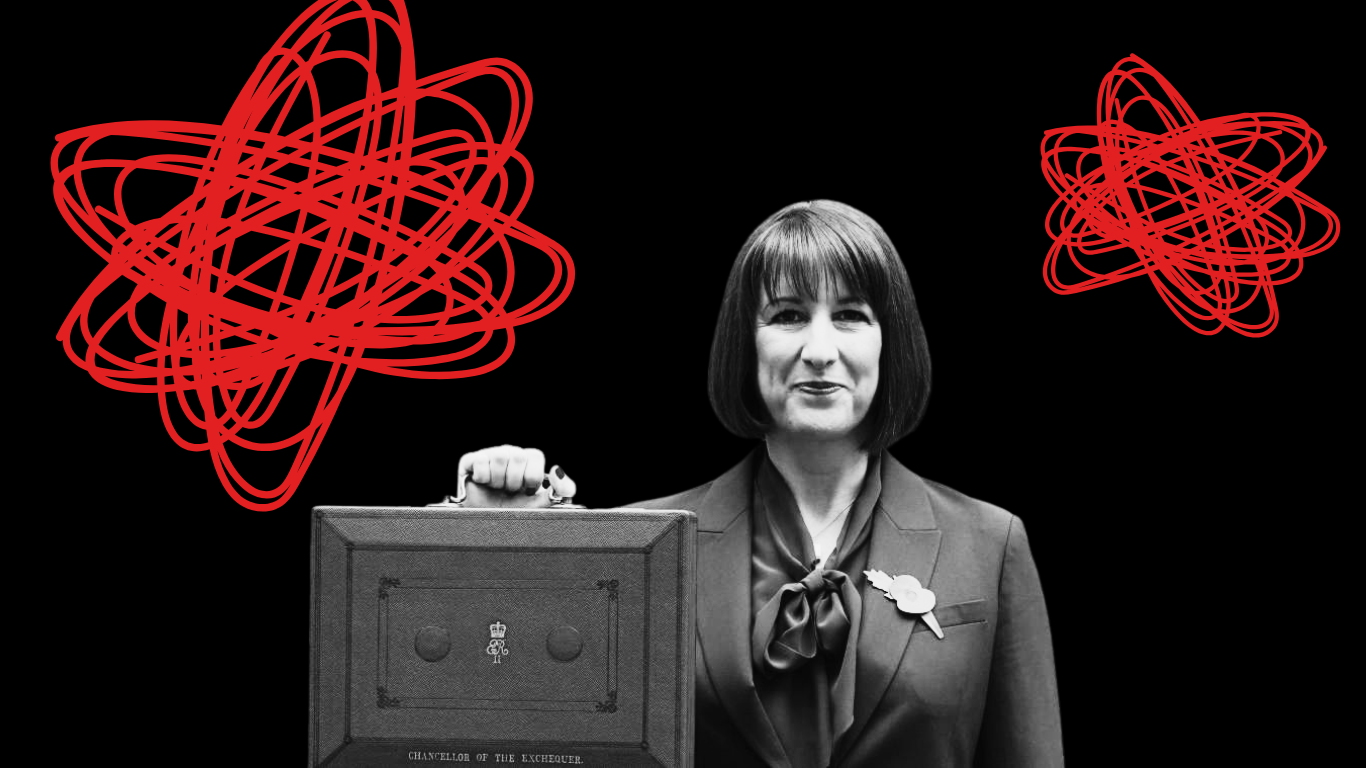

The Non-Dom Changes Explained

14 February 2025We take a look at the changes to the non-dom regime and what this means for individuals and their estates in the UK.

-

Freelancers: Stay Compliant, Avoid Surprises, and Save Money

20 January 2025Here’s a simple guide for freelancers to staying compliant, avoiding unexpected bills, and keeping more of your hard-earned income in your pocket.

-

Key Questions to Ask When Hiring an Accountancy Firm

13 January 2025Hiring the right accountancy firm is a big decision. It’s not just about finding someone to manage your numbers; it’s about building a lasting relationship with experts who understand your business and help it grow.

-

Divorce Day: Essential Tax Tips For Separating Couples

8 January 2025January 8, often referred to as “Divorce Day,” marks a significant spike in couples initiating divorce proceedings after the holidays. But what does divorce mean when it comes to tax?

-

Your Business Calendar – The Crucial Dates for 2025

23 December 2024Here’s a breakdown of the crucial financial and tax dates for your business in 2025, in a way that you can actually understand.

-

2025 Personal Tax Returns – What You Need To Know

29 November 2024Find out all about filing your annual self-assessment/personal tax returns, and what happens if you don’t do it in time.

-

Tax Returns: Strategies To Help You Avoid Mistakes

20 November 2024Key strategies to avoid tax return mistakes and ensure accurate filings. Learn how meticulous record-keeping, professional advice, and technology can safeguard your business’s financial health.