Let’s be honest, most people do not get excited when they hear words like ‘company thresholds’ or ‘financial reporting obligations’. It sounds technical and far removed from the everyday reality of running a business. The changes coming in April 2025 might work in your favour. They could save you time, money and a lot of admin stress.

What’s changing from April 2025?

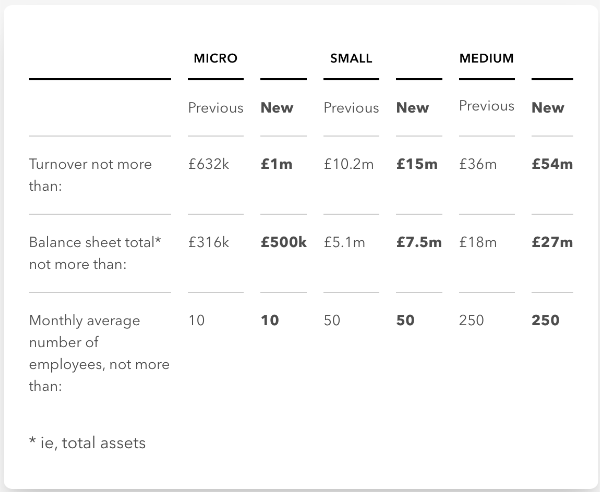

From April next year the UK government is officially increasing the financial thresholds that decide whether your business is considered micro, small, medium or large. These thresholds are used to group companies based on things like how much money they make, how many people they employ and what their overall financial position looks like.

Once a company is placed in a category that determines what kind of reports and financial statements it must submit every year. For example a large company has more rules to follow. It might need an audit, a strategic report or detailed paperwork explaining how it runs the business. A micro or small company on the other hand can get away with doing much less.

The process is lighter, faster and cheaper.

Why is the government making this change now?

The last time these numbers were updated properly was in 2016. Since then inflation has gone up. The economy has changed. The way people run businesses has evolved too. What was considered ‘small’ back then might not be small anymore in today’s terms. That is why the government is increasing the thresholds by around 50 per cent. It brings things more in line with the world we live in now.

How will this work in real life?

Let’s say your business had an annual turnover of £900,000 last year. You might have just missed the cut off to be classed as a micro entity. That would mean you would have to follow more rules, submit longer accounts or even get an audit.

But under the new rules the turnover threshold for a micro business is increasing to £1 million. Your business could now fall into that lighter simpler category.

The same applies to small and medium companies. For instance the turnover limit for small companies is rising from £10.2 million to £15 million. That means thousands of businesses will now be eligible for reduced reporting simply by falling into a different size bracket.

What about the two year rule?

Normally a company would need to meet the new criteria for two years before their status officially changes. But for this update the government has introduced a transition rule.

This means companies can act as if the new thresholds applied last year too. So if your financial year ends after April 2025 you do not have to wait until 2027 to benefit. You can apply the changes straight away.

What do you actually gain if you move down a category?

Let us say your company goes from medium to small. That could mean you no longer have to produce a strategic report which usually includes how your business engages with employees or customers. You might also no longer need an audit depending on your structure.

Or maybe you will go from small to micro. Micro entities do not need to submit a director’s report and can file the most simplified version of accounts available.

Changes to the Directors Report

From April 2025 companies that remain medium or large will also see changes. Several sections will no longer be legally required in the Directors Report.

This includes things like:

- Future business plans

- Use of financial instruments

- Research activity

- Overseas branch details

- Employment of disabled persons

- Customer or supplier engagement

These changes aim to remove duplication. Many of these topics are already covered in other reports or simply add unnecessary admin.

Why this matters for business owners

The goal here is to reduce pressure and save time, especially for smaller companies who might not have large in-house finance teams. It lets you focus more on building your business instead of getting stuck in compliance.

What should you do next?

If you are not sure what category your company will fall under once the new rules take effect you are not alone. Many business owners are in the same position.

At Nordens we are already helping our clients understand the impact. We are reviewing their reporting status, checking audit needs and keeping an eye on upcoming legislation expected later this year.

So… what now?

If you run a business or even just work in one this is the time to reassess. Could your company now qualify for simpler reporting? Do you still need an audit? Are you preparing reports you no longer need to?

This is not about cutting corners. It is about being smart, staying compliant and giving your business more room to grow.

Contact Us

📩 Need help understanding how this affects your business?

Get in touch with us at enquiries@nordens.co.uk

We are ready to support you through the transition.